3. First house construction and 4% VAT

It is possible to request the reduced VAT to 4% if the goods purchased are intended for a first house under construction (the property, however, must not have luxury characteristics), in which some products are not supplied by the manufacturer, such as sanitary ware, shower box, bathtub, mixer, sinks - for bathroom furniture it is possible to apply the reduced VAT only on the sink - and therefore the property owner buys them to complete the home.

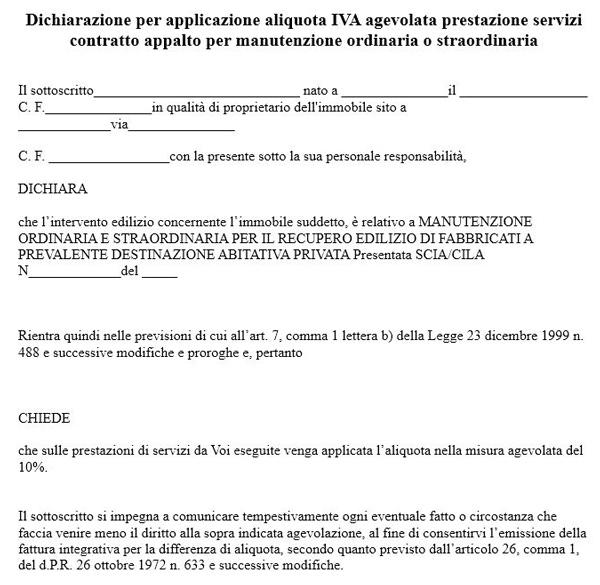

In order to obtain it, all the necessary documentation must be provided:

- Photocopy of a valid ID

- Photocopy of the tax code

- Copy of the building permit with current validity (maximum 3 years)

- Self-certification available in the offices of your municipality

The 4% subsidized VAT is not applied to furniture, mirrors and accessories.

4. 10% VAT for building constructions with Tupini Law requirements

The Revenue Agency confirms that, for procurement contracts relating to the construction of "Tupini" buildings, it is possible to apply the reduced

VAT rate of 10%.

The buildings defined as Tupini are those which, considered as a whole, have a prevalent use for homes, but are made up of both residential units and shops/offices, however, respecting certain proportions:

- residential houses, including offices and shops, which do not meet the requirements of "luxury" housing;

- more than 50% of the total surface of the floors above ground must be used for residential purposes;

- no more than 25% of the total surface of the floors above ground can be used for shops.

Tax concessions relate exclusively to "significant" assets such as

sanitary ware, shower cubicles, hydromassage tubs and cabins, mixers, radiators.

In order to obtain it, all the necessary documentation must be provided:

- Photocopy of a valid ID

- Photocopy of the tax code

- DIA / SCIA (Business Start Report) in the name of the buyer (in case of renovation)

- Self-certification available in the offices of your municipality

How to get the benefits

To obtain or request one of these deductions, simply place the order on our website

indicating the payment by bank transfer and then sending all the required documents. We will then adjust the VAT and give you the exact amount to be transferred.

Please pay attention! The documentation provided, as well as the billing and payment details, must be from the same person.